Taking financial futures above and beyond

At MassMutual Ascend, we are committed to going above and beyond – so when it comes to your financial future, the impossible feels possible.

As a leading provider of annuities, the status quo isn’t a status we ever want. We’ll always be in pursuit of better. Whether you want to protect your savings, accumulate more or leave a legacy for your loved ones, we’re here to help get you on the road to reaching your goals.

Watch video

A long history of strength

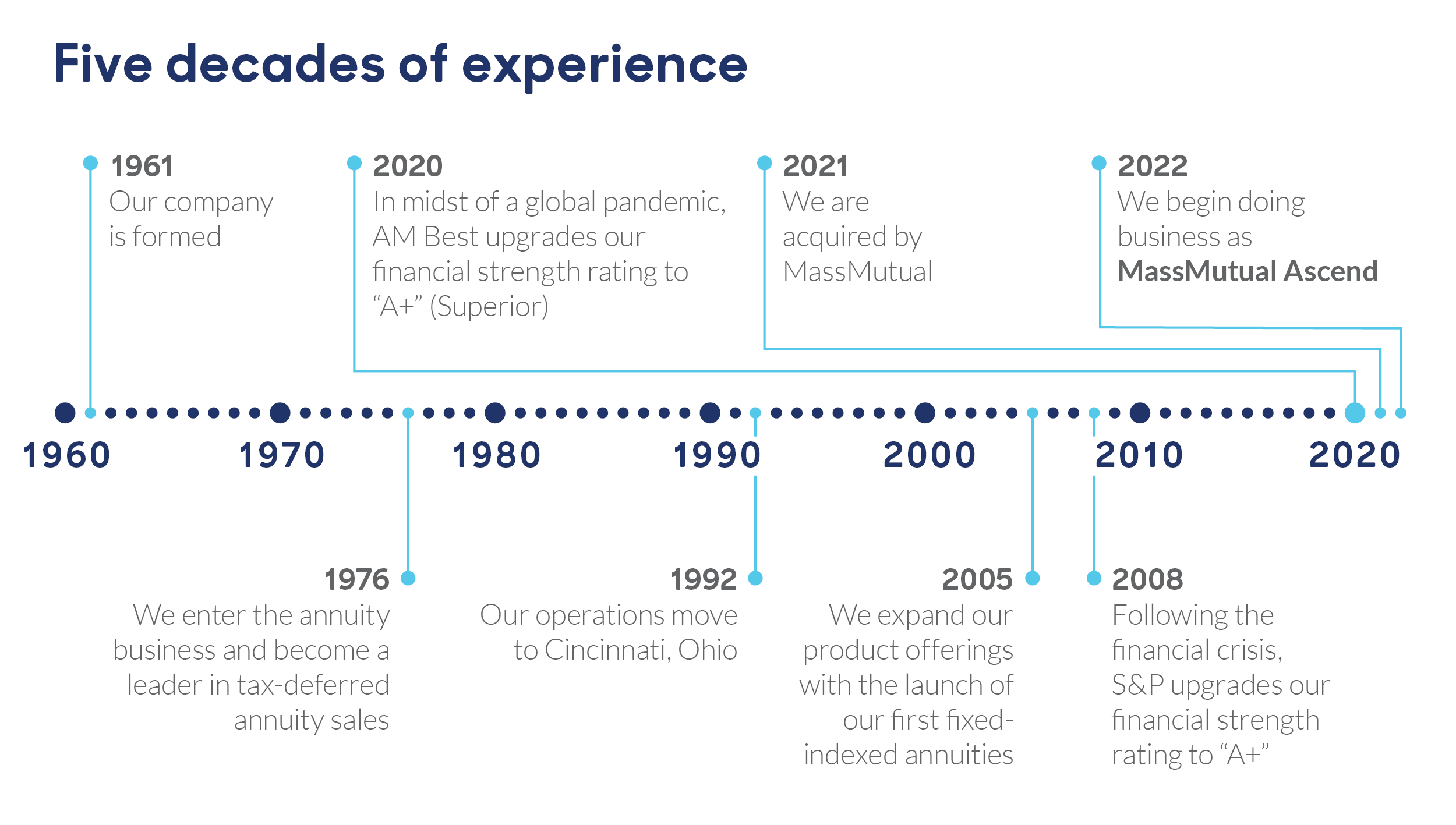

As a proud subsidiary of MassMutual with more than five decades of experience, we are proud to offer customers a level of strength and stability they can count on for years to come. We take a long-term approach to managing our business that is focused on delivering value to our customers while maintaining the highest level of financial strength.

Three keys to success

Solid operating performance

In the last decade, our gross annuity premiums have more than doubled to $58 billion. This tremendous premium growth demonstrates our continuing commitment to providing annuities that can help you reach your long-term goals.

Record capital

At MassMutual Ascend, we have the financial backing to continue to grow and weather the inevitable swings in the financial marketplace. All insurers are required to maintain a minimum level of risk-based capital to support business operations while offering annuities. Our risk-based capital level significantly exceeds the requirement.

Long-term investment approach

We are one of the most conservatively managed annuity providers in the marketplace. Fixed income investments comprise approximately 80 percent of our invested assets, compared to the insurance industry average of approximately 73 percent.

Find your ideal fit

Answer a few short questions to tell us where you are in your financial planning journey, including when you plan to retire, your risk tolerance and additional needs. From there, we'll help you find the right annuity solution.

Start retirement assessment

Our commitment to our customers is as strong as ever

Since 2000, we have paid more than $15 billion in guaranteed income benefits to our valued contract owners, including more than $1.5 billion in 2025.

MassMutual Ascend is a proud subsidiary of MassMutual

In 2021, we were acquired by MassMutual, one of the largest life insurance companies in the U.S., founded in 1851. They were drawn to our company because of our continued growth as a leading annuity provider and long-standing reputation for providing superior customer service. We continue to operate as an independent subsidiary of MassMutual, which allows us to stay focused on serving the unique needs of our customers, while leveraging the investment capabilities, reputation and financial strength of MassMutual.

Ready to get started?

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.

Additional resources

AM Best rating of “A++” (Superior) affirmed October 23, 2025. AM Best rating of "A++" is the highest of 16 ratings. S&P rating of “AA” upgraded on February 20, 2025.

All data is as of December 31, 2025.

Data reflects annuity premiums measured on the basis used to prepare statutory annual statements. Includes MassMutual Ascend Life Insurance Company and its wholly-owned subsidiary, Annuity Investors Life Insurance Company®.

MassMutual Ascend’s fixed income investments include bonds, cash, short-term investments and policy loans. Life insurance industry data sourced from SP MI - L/H, US Version 2024.

The guaranteed income benefit amount includes annuity benefit payments under immediate and deferred annuities, income benefit payments under guaranteed withdrawal benefit riders and contract withdrawals taken by owners after their rider benefit payments began.