Can your portfolio withstand a bear market?

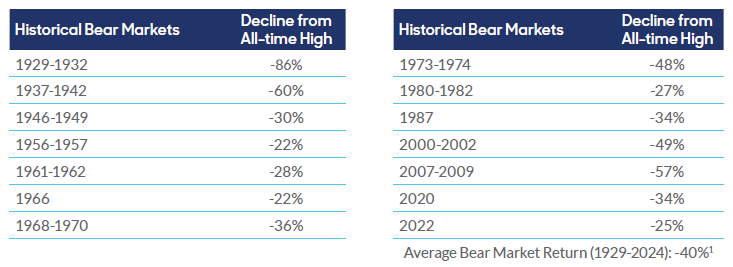

Early 2020 marked the end of the longest-running bull market in modern history. Since then, the market has navigated in and out of bull and bear market territory. This may have you concerned with volatility, and for good reason - the average bear market return since 1929 is -40%. Could you afford for your $100,000 investment to become $60,000?

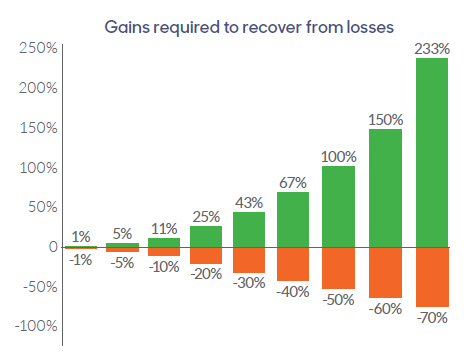

Plus, it can take a significant return to recover from loss.

An annuity from MassMutual Ascend can help protect against bear markets. These products offer competitive growth potential while providing varying levels of protection against market declines.

For advice tailored to your specific circumstances, contact your financial professional.

1J.P. Morgan Asset Management, Guide to the Markets - U.S., Data as of December 31, 2024. (Average return is representative of bear markets from 1929-2024).

A bear market is defined as a 20% or more decline from the previous market high. The bear return is the peak to trough return over the cycle. Data is as of 12/31/2024.

When you buy an annuity, you own an insurance contract. You are not buying shares of any stock or investing in an index. Annuities are intended to be long-term investments and may not be suitable for all investors. Withdrawals from an annuity contract may have tax consequences.

ICC24-P1841624NW, P1841722NW, P1841722ID, and ICC24-P1850824NW. Contract form numbers vary by state.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6085924NW

Have questions?

Speak with an annuity expert for no pressure, thoughtful insight to help plan a perfectly protected retirement.