How sequence of returns can make or break a portfolio

When you begin taking income from a portfolio, the subsequent sequence of returns can have a critical impact on its value over time. While early positive returns can help grow a portfolio to a point where it could withstand a downturn, early negative returns can cause a portfolio to lose value at a faster rate – jeopardizing your plans for future income.

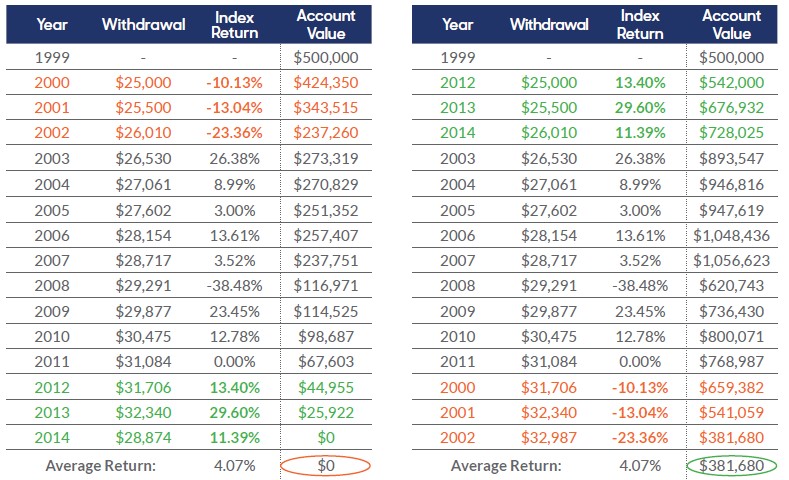

Sequence of returns comparison

Say you invest $500,000 in the stocks that make up the S&P 500® and decide to take an initial withdrawal of $25,000 during your first year of retirement. In each of the following years, you increase that amount by 2% to account for inflation. The two scenarios below show how a poor sequence of returns early on can impact your portfolio over the years.

In both scenarios, the average return is the same. However, early negative returns caused the portfolio to deplete to $0 over fifteen years, where early positive returns left a portfolio balance of over $381,000.

Talk to your financial professional about how an annuity from MassMutual Ascend can help mitigate market risk and provide guaranteed income in retirement.

For advice tailored to your specific circumstances, contact your financial professional.

For use with contract forms P1020203NW, P1020212ID, ICC25-P1174525NW, P1138919NW, P1138919ID, ICC24-P1172524NW, P1088011NW, P1088011ID, P1088111NW, P1088111ID, ICC25-P1174925NW, ICC24-P1172024NW, ICC21-P1151621NW, P1074514NW, P1074514ID, P1470017NW, P1470017ID, ICC21-P1152021NW, ICC21-P1152121NW, ICC21-P1476721NW, P1140119NW, P1140119ID, P1140219NW, P1140219ID, P1146620NW, P1146620ID, P1110416NW, P1110416ID, ICC20-P1144420NW and ICC20-P1144420NW-NoMVA, ICC20-P1144520NW and ICC20-P1144520NW-NoMVA, ICC20-P1474420NW and ICC20-P1474420NW-NoMVA, P1134618NW, P1134618ID and P1134618ID-NoMVA, P1112916NW, P1112916ID, P1129918NW, P1129918ID and P1129918ID-NoMVA, ICC24-P1825224NW, ICC24-P1833624NW, ICC24-P1850824NW, ICC24-P1841724NW, ICC24-P1841624NW. Form numbers vary by state.

When you buy an annuity, you own an insurance contract. You are not buying shares of any stock or investing in an index. Annuities are intended to be long-term investments and may not be suitable for all investors. Withdrawals from an annuity contract may have tax consequences. MassMutual Ascend’sSM registered index-linked annuities can only be sold through a Broker/Dealer that is contracted with MassMutual Ascend. This material must be preceded or accompanied by a prospectus. To obtain a copy of the prospectus, please visit MassMutualAscend.com/RILArates.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by MassMutual Ascend. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by MassMutual Ascend. MassMutual Ascend’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties makes any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Principal Underwriter/Distributor: MM Ascend Life Investor Services, LLC, member FINRA and an affiliate of MassMutual Ascend Life Insurance Company.

Products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual). Products not available in all states.

All guarantees subject to the claims-paying ability of MassMutual Ascend Life Insurance Company.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6085225NW

Have questions?

Speak with an annuity expert for no pressure, thoughtful insight to help plan a perfectly protected retirement.