Leaving a legacy

From MassMutual Ascend Life Insurance Company

Stretching your IRA or non-qualified annuity

Make your money mean more to future generations

You've worked hard to secure your financial future and may have additional assets you want to leave for your loved ones. Taking only the Required Minimum Distribution (RMD) from your IRA, or allowing your non-qualified annuity to continue to grow tax-deferred, could help minimize your own taxes and leave funds for your beneficiaries. However, when these assets pass to your beneficiaries, taking a distribution as a lump sum can cause significant tax burdens for your loved ones.

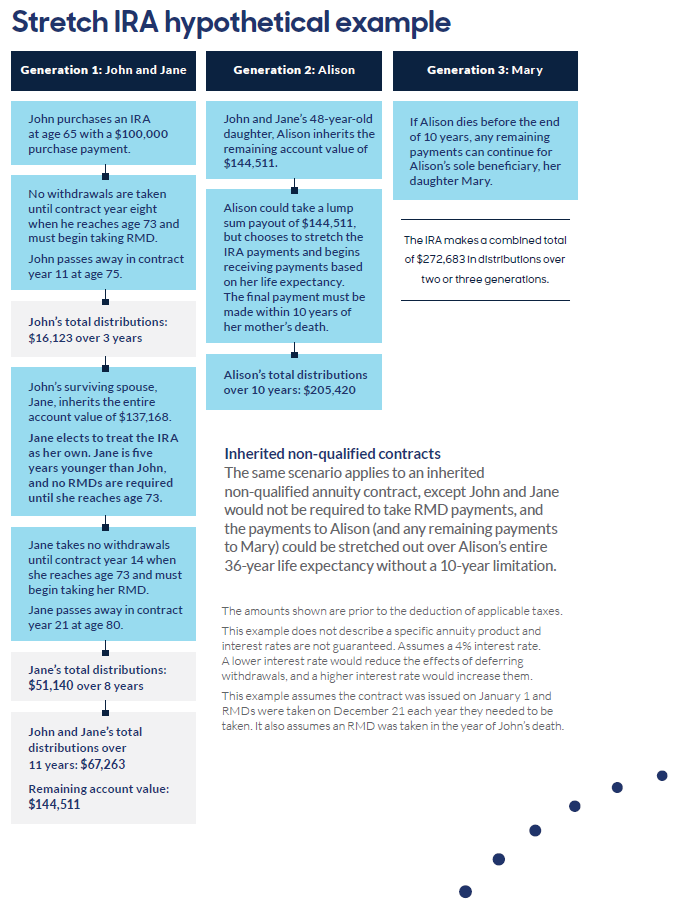

Your beneficiary can reduce this tax burden by choosing to stretch out payments rather than taking a lump sum. Stretching out payments allows the money to grow tax-deferred, spreads the tax liability across multiple years and may avoid higher tax brackets.

Taking advantage of compound growth and tax deferral

By stretching out payments, the IRA or non-qualified annuity can continue to grow and compound on a tax-deferred basis. The accumulated earnings are not taxed until the beneficiary receives them. This deferral allows your beneficiary to maximize growth and minimize the tax burden.

Income flexibility

Unless your benefits are paid under a restriction you have imposed or a contract is annuitized, a beneficiary can choose to increase payout amounts or cash out at any time. This means your beneficiary can access additional amounts should a special need arise.

Transfer of wealth to multiple generations

If your beneficiary stretches out payments from your IRA or non-qualified annuity, but dies before all benefits are paid, any remaining balance can be passed on to future generations.

Payments can continue to be stretched out over the original stretch period. Consider the following example to see how a stretch strategy provides significant benefits across three generations.

For advice tailored to your specific circumstances, contact your financial professional.

This information is not intended or written to be used as legal or tax advice. It was written solely to support the sale of annuity products. You should seek advice on legal or tax questions based on your particular circumstances from an independent attorney or tax advisor.

For use with contract forms P1020203NW, P1020212ID, ICC22-P1165222NW, P1463016NW, P1463016ID, P1459716NW, P1459716ID, P1138919NW, P1138919ID, ICC24-P1172524NW, P1088011NW, P1088011ID, P1088111NW, P1088111ID, ICC22-P1165322NW, P1123117NW, P1123117ID, P1123217NW, P1123217ID, ICC21-P1152221NW, ICC24-P1172024NW, ICC21-P1151521NW, P1086811NW, P1086811ID, P1081610NW, P1081610ID, ICC21-P1151621NW, P1074514NW, P1074514ID, P1470017NW, P1470017ID, ICC21-P1152021NW, ICC21-P1152121NW, ICC21-P1476721NW, P1140119NW, P1140119ID, P1140219NW, P1140219ID, P1146620NW, P1146620ID, P1110416NW, P1110416ID, ICC20-P1144420NW and ICC20-P1144420NW-NoMVA, ICC20-P1144520NW and ICC20-P1144520NW-NoMVA, ICC20-P1474420NW and ICC20-P1474420NW-NoMVA, P1134618NW, P1134618ID and P1134618ID-NoMVA, P1112916NW, P1112916ID, P1129918NW, P1129918ID and P1129918ID-NoMVA, P1825218NW, P1825218ID, P1833621NW, P1833621ID, P1850822NW, P1850822ID, P1841722NW, P1841722NW, P1841622NW, P1841622ID. Contract form numbers may vary by state. Products and features may vary by state, and may not be available in all states. See specific product disclosure document for details.

Products issued by MassMutual Ascen Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual).

All guarantees subject to the claims-paying ability of MassMutual Ascend Life Insurance Company.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6084525NW

Have questions?

Speak with an annuity expert for no pressure, thoughtful insight to help plan a perfectly protected retirement.