Power of tax-deferred growth

Annuities come with a number of benefits, such as protection from loss, guaranteed retirement income and legacy solutions for your loved ones. But one benefit that can play a fundamental role in the growth of your retirement savings is tax deferral.

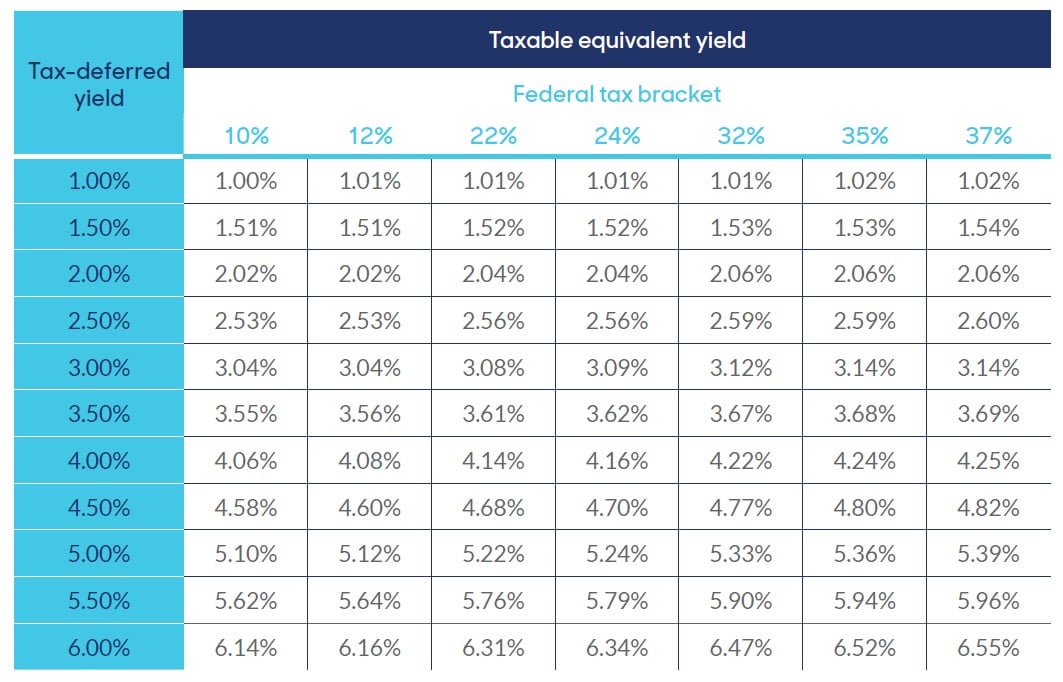

During the accumulation period, the interest credited is untouched by current federal income tax, meaning your account value grows at a faster rate. The table below shows the yield that would never be required from a taxable investment to equal that of a tax-deferred investment over a 10-year period.

Example assumes a non-qualified annuity over a 10-year period, and that the investment is made on the first day of a 10-year timeframe with no withdrawals. Example also assumes taxes on earnings paid annually on the taxable investment, taxes paid at the end of the 10-year period on the tax-deferred investment, taxes on the taxable investment are the same as taxes on the non-qualified annuity, and that tax rates are constant.

For advice tailored to your specific circumstances, contact your financial professional.

numbers vary by state.

This information is not intended or written to be used as legal or tax advice. It cannot be used by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. It was written solely to support the sale of annuity products. You should seek advice on legal or tax questions based on your particular circumstances from an independent attorney or tax advisor.

Products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual).

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6083425NW

Have questions?

Speak with an annuity expert for no pressure, thoughtful insight to help plan a perfectly protected retirement.