Insights

When it comes to planning for a secure financial future, there are a lot of factors to consider – like market volatility, interest rates and social security, to name a few. Explore our insights library for information and resources that can help.

Filter by topic

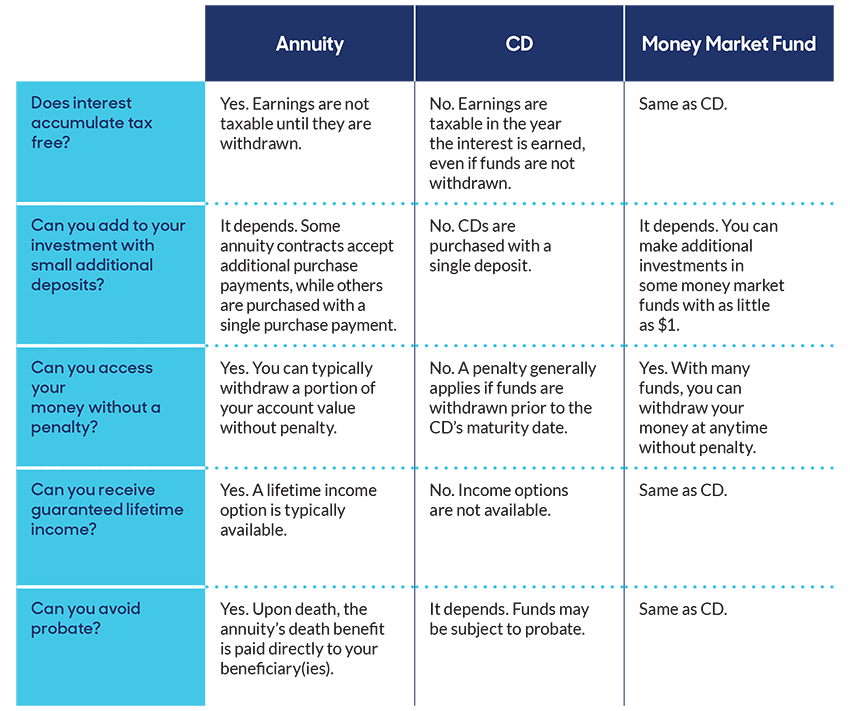

Annuity quick comparison

Achieving financial security means finding the right mix of options to meet your unique needs. This quick comparison can help you determine if an annuity offers advantages that might be missing from your portfolio.

Annuities are typically used to meet long-term financial goals, while CDs and money market funds are typically used to meet shorter-term financial goals. The comparisons in this flier assume the CD and money market fund are not held in a tax-qualified account. Withdrawals and distributions from an annuity may be subject to early withdrawal charges and income tax and, for some tax qualifications, may be restricted. If withdrawals or distributions are taken from an annuity prior to age 59½, a 10% federal penalty tax may apply. Annuities and money market funds are not FDIC insured, while CDs generally are FDIC insured.

For advice tailored to your specific circumstances, contact your financial professional.

For use with contract forms P1020203NW, P1020212ID, ICC25-P1174525NW, P1138919NW, P1138919ID, ICC24-P1172524NW, P1088011NW, P1088011ID, P1088111NW, P1088111ID, ICC25-P1174925NW, ICC24-P1172024NW, ICC21-P1151621NW, P1074514NW, P1074514ID, P1470017NW, P1470017ID, ICC21-P1152021NW, ICC21-P1152121NW, ICC21-P1476721NW, P1140119NW, P1140119ID, P1140219NW, P1140219ID, P1146620NW, P1146620ID, P1110416NW, P1110416ID, ICC20-P1144420NW and ICC20-P1144420NW-NoMVA, ICC20-P1144520NW and ICC20-P1144520NW-NoMVA, ICC20-P1474420NW and ICC20-P1474420NW-NoMVA, P1134618NW, P1134618ID and P1134618ID-NoMVA, P1112916NW, P1112916ID, P1129918NW, P1129918ID and P1129918ID-NoMVA, ICC24-P1825224NW, ICC24-P1833624NW, ICC24-P1850824NW, ICC24-P1841724NW, and ICC24-P1841624NW. Form numbers vary by state.

Annuities are typically used to meet long-term financial goals, while CDs and money market funds are typically used to meet shorter-term financial goals. The comparisons in this flier assume the CD and money market fund are not held in a tax-qualified account. Withdrawals and distributions from an annuity may be subject to early withdrawal charges and income tax and, for some tax qualifications, may be restricted. If withdrawals or distributions are taken from an annuity prior to age 59½, a 10% federal penalty tax may apply. Annuities and money market funds are not FDIC insured, while CDs generally are FDIC insured.

This information is not intended or written to be used as legal or tax advice. You should seek advice on legal and tax questions from an independent attorney or tax advisor. Guarantees included in annuity products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual). Consult with your financial professional about options that might be right for you.

All guarantees subject to the claims-paying ability of MassMutual Ascend Life Insurance Company.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6085025NW

Have questions? Get in touch with a financial professional.

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.