Insights

When it comes to planning for a secure financial future, there are a lot of factors to consider – like market volatility, interest rates and social security, to name a few. Explore our insights library for information and resources that can help.

Filter by topic

See how your financial future adds up

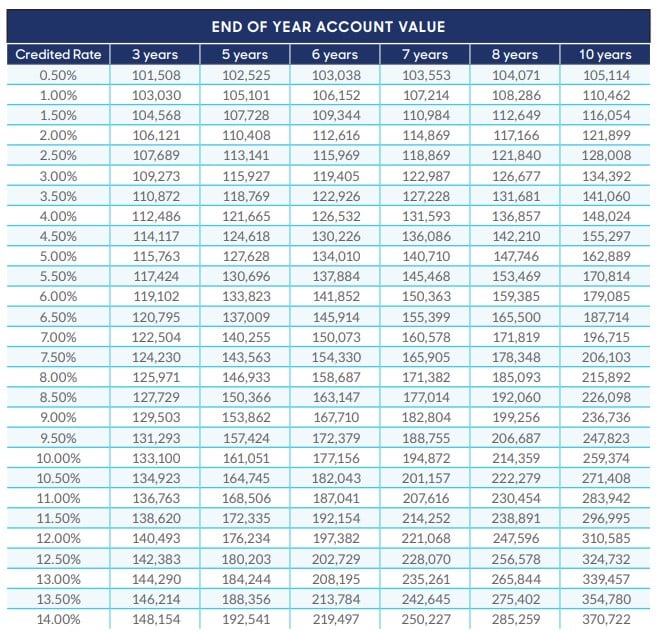

Preparing for a secure financial future involves finding a product that can help you reach your goals. Two factors that determine how much money you accumulate are your time horizon and the credited interest rate.

The following table shows how a hypothetical $100,000 purchase payment would grow at various interest rates and over various time periods.

Example assumes a $100,000 purchase payment and no withdrawals. Contract charges will apply if money is withdrawn during the early withdrawal charge period. Amounts withdrawn may be subject to taxes.

For advice tailored to your specific circumstances, contact your financial professional.

P1470017ID, P1104414ID, ICC24-P1172524NW, ICC25-P1174525NW, ICC25-P1174925NW and ICC24-P1172024NW. Form numbers vary by state.

Example assumes a $100,000 purchase payment and no withdrawals. Contract charges will apply if money is withdrawn during the early withdrawal charge period. Amounts withdrawn may be subject to taxes.

Products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual). Consult with your financial professional about options that might be right for you.

All guarantees subject to the claims-paying ability of MassMutual Ascend Life Insurance Company.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6083625NW

Have questions? Get in touch with a financial professional.

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.