Insights

When it comes to planning for a secure financial future, there are a lot of factors to consider – like market volatility, interest rates and social security, to name a few. Explore our insights library for information and resources that can help.

Filter by topic

The benefits of diversification in a fixed-indexed annuity

Pursue growth and manage market risk with your fixed-indexed annuity

No one can predict future market performance with certainty. That's why it's important to consider diversifying your allocation options within your fixed-indexed annuity (FIA), which can help enhance the overall performance and stability of your FIA over time.

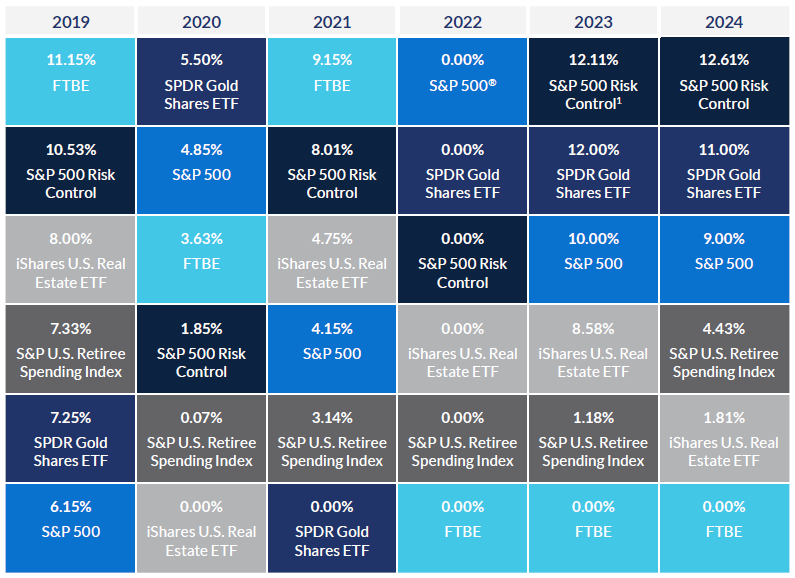

No single strategy performs best every year

With an FIA from MassMutual Ascend, you aren't investing your money directly in the market. Instead, you allocate funds to indexed strategies, which provide market-linked growth potential and complete downside protection. Funds in an indexed strategy earn interest that is based, in part, on positive performance of an external index or an exchange traded fund (ETF) over a term year.

But deciding which indexed strategy to choose isn't an exact science, because no single strategy performs best every year. Consider the following chart that compares the historical performance of some of our indexed strategies over the most recent six calendar-year period.

MassMutual Ascend FIA Index Strategy Returns

Interest credits based on historical index returns using historical caps and participation rates for American Legend 7 for new money allocated to the strategy on 1/7 of each calendar year. The launch date of the First Trust Barclays Edge Index was April 14, 2023. Any data illustrated for this index strategy before that date is using a hypothetical data set and assumptions.

1S&P 500 Average Daily Risk Control 10%TM

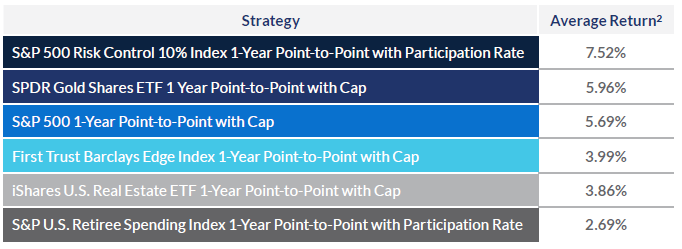

Indexed Strategy Average Return 2019-2024

2Average return based on historical performance data from 2019-2024.

Diversifying can help you navigate your investment with confidence

Since it's impossible to know which index will perform best at any given time, it makes sense to not put all your eggs in one basket. Properly diversifying your investment can open new avenues for growth while managing risk more effectively.

By allocating your premium across a variety of indexed strategies, you can:

- Provide access to a broad range of investments that may help grow your money in different market conditions.

- Spread risk by limiting your exposure to any one index and lessen volatility within your portfolio over time.

- Reduce your chances of earning zero interest credits in any given crediting period.

Taking advantage of the unique characteristics of multiple index options may be an effective way to achieve your long-term savings goals.

Put diversification in action

While a diversified allocation within your annuity does not guarantee a profit, it can help provide balance during market volatility and help mitigate risk by limiting your exposure to any one index. Whether you're seeking stability, long-term gains, or a combination of both, diversification within your FIA can help build confidence as you plan for your financial future.

To learn more about diversification within an FIA, check out our "The benefits of diversification in fixed-indexed annuity" brochure.

Work with your financial professional to create a diversified strategy inside of your MassMutual Ascend fixed-indexed annuity that's right for you.

For advice tailored to your specific circumstances, contact your financial professional.

IMPORTANT DISCLOSURE RELATING TO BACK TESTED INDEX WEIGHTINGS

This material is provided for information purposes only and to provide general information about the historical exposures of the index’s equity and fixed income components as a result of the application of the index methodology and has inherent limitations. It is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument, or to enter into a transaction involving any financial instrument. Nothing in this material should be construed as investment, tax, legal, accounting, regulatory or other advice.

The back tested performance included has many inherent limitations, some of which are described below:

• Hypothetical exposures are achieved by implementing the index’s methodology.

• The creation of historical index exposures involves assumptions and the benefit of hindsight and do not reflect the impact that material market or economic events might have had on the underlying indexes or volatility control weightings.

• No representation is being made that the Index will maintain to similar exposures in the future. Actual results will materially vary from the hypothetical performance levels presented herein.

When you buy a fixed-indexed annuity, you own an insurance contract. You are not buying shares of any stock or index. You cannot invest directly in an index.

These tables are not intended to show past or future performance of any indexed strategy. There is not one particular crediting method or indexed strategy that performs better than others in all market environments.

The "S&P 500®”, the “S&P 500 Average Daily Risk Control 10% Price Return Index” and the “S&P U.S. Retiree Spending Index" are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by MassMutual Ascend Life Insurance Company. S&P®, S&P 500®, S&P 500 Average Daily Risk Control 10%™, SPDR®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); MassMutual Ascend Life Insurance Company’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the S&P 500®, the S&P 500 Average Daily Risk Control 10% Price Return Index or the S&P U.S. Retiree Spending Index.

The iShares MSCI EAFE ETF and the iShares U.S. Real Estate ETF are distributed by BlackRock Investments, LLC. iShares®, BLACKROCK®, and the corresponding logos are registered and unregistered trademarks of BlackRock, Inc. and its affiliates (“BlackRock”), and these trademarks have been licensed for certain purposes by MassMutual Ascend Life Insurance Company. MassMutual Ascend Life Insurance Company annuity products are not sponsored, endorsed, sold or promoted by BlackRock, and purchasers of an annuity from MassMutual Ascend Life Insurance Company do not acquire any interest in the iShares MSCI EAFE ETF or the iShares U.S. Real Estate ETF nor enter into any relationship of any kind with BlackRock. BlackRock makes no representation or warranty, express or implied, to the owners of any MassMutual Ascend Life Insurance Company annuity product or any member of the public regarding the advisability of purchasing an annuity, nor does it have any liability for any errors, omissions, interruptions or use of the iShares MSCI EAFE ETF or the iShares U.S. Real Estate ETF or any data related thereto.

The First Trust Barclays Edge Index (“FTIS Index”) is a product of FT Indexing Solutions LLC (“FTIS”) and is administered and calculated by Bloomberg Index Service Limited and its affiliates (collectively, “BISL”). FIRST TRUST® and First Trust Barclays Edge Index are trademarks of First Trust Portfolios L.P. (collectively, with FTIS and their respective affiliates, “First Trust”). The foregoing index and trademarks have been licensed for use for certain purposes by Barclays, Bloomberg, and MassMutual Ascend Life Insurance Company (collectively, the “Licensees”) in connection with the FTIS Index and certain products utilizing the FTIS Index (collectively, the “Products”).

The Capital Strength Index (“Nasdaq Index”) is a product of Nasdaq, Inc. (collectively, with its affiliates, “Nasdaq”). NASDAQ®, CAPITAL STRENGTH INDEX™, NQCAPST™, and NQCAPSTT™ are trademarks of Nasdaq. The foregoing index and trademarks have been licensed for use for certain purposes by FTIS and Licensees in connection with the FTIS Index and the Products.

The Value Line Dividend Index (“Value Line Index”) is a product of Value Line, Inc. (“Value Line”). VALUE LINE® and VALUE LINE DIVIDEND INDEX™ are trademarks or registered trademarks of Value Line. The foregoing index and trademarks have been licensed for use for certain purposes by FTIS and Licensees in connection with the FTIS Index and the Products. The FTIS Index is not sponsored, endorsed, recommended, sold or promoted by Value Line and Value Line makes no representation regarding the advisability of investing in any product utilizing the FTIS Index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. Bloomberg Finance L.P., BISL, and their affiliates (“Bloomberg”) are not affiliated with First Trust or Barclays. Bloomberg’s relationship to First Trust and Barclays is only (1) in the licensing of the FIRST TRUST®, BARCLAYS®, and FIRST TRUST BARCLAYS EDGE INDEX™ trademarks and (2) to act as the administrator and calculation agent of the FTIS Index, which is the property of FTIS. Bloomberg does not guarantee the timeliness, accurateness, or completeness of the FTIS Index or any data or information relating thereto and shall have no liability in connection with the FTIS Index or any data or information relating thereto.

The Products are not issued, sponsored, endorsed, sold, recommended, or promoted by First Trust, Bloomberg, Nasdaq, Value Line, or their respective affiliates (collectively, the “Companies”). The Companies do not make any representation regarding the advisability of investing in the Products or products based on the FTIS Index, Barclays Indices, Nasdaq Index, or Value Line Index, do not make any warranties or bear any liability with respect to such products, and do not make any warranties or bear any liability with respect to the Products, the FTIS Index, or another party’s index.

THE COMPANIES DO NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS, COMPLETENESS, AND/OR UNINTERRUPTED CALCULATION OF THE PRODUCTS, FTIS INDEX, BARCLAYS INDICES, NASDAQ INDEX, VALUE LINE INDEX, OR ANY DATA INCLUDED THEREIN OR ANY COMMUNICATION WITH RESPECT THERETO, INCLUDING, ORAL, WRITTEN, OR ELECTRONIC COMMUNICATIONS. THE COMPANIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS IN THE PRODUCTS, FTIS INDEX, BARCLAYS INDICES, NASDAQ INDEX, OR VALUE LINE INDEX. THE COMPANIES MAKE NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE RESULTS TO BE OBTAINED BY LICENSEES, OWNERS OF THE PRODUCTS OR OF PRODUCTS BASED ON THE FTIS INDEX, BARCLAYS INDICES, NASDAQ INDEX, OR VALUE LINE INDEX, OR BY ANY OTHER PERSON OR ENTITY FROM THE USE OF THE FTIS INDEX, BARCLAYS INDICES, NASDAQ INDEX, OR VALUE LINE INDEX, OR ANY DATA INCLUDED THEREIN.

Neither Barclays Bank PLC (‘BB PL’) nor any of its affiliates (collectively ‘Barclays’) is the issuer or producer of MassMutual Ascend’s products and Barclays has no responsibilities, obligations or duties to investors in MassMutual Ascend’s products. The Barclays US 2Y Treasury Futures Index, Barclays US 5Y Treasury Futures Index, Barclays US 10Y Treasury Note Index, and Barclays Switch USD Signal Index (collectively, the “Indices”), together with any Barclays indices that are components of the Indices, are trademarks owned by Barclays and, together with any component indices and index data, are licensed for use by FTIS in connection with the First Trust Barclays Edge Index.

Barclays’ only relationship with the MassMutual Ascend in respect of the Indices is the licensing of the Indices to FTIS, which are administered, compiled and published by BB PLC in its role as the index sponsor (the ‘Index Sponsor’) without regard to MassMutual Ascend’s products or investors in MassMutual Ascend’s products. Additionally, MassMutual Ascend as issuer or producer of MassMutual Ascend’s products may for itself execute transaction(s) with Barclays in or relating to the Indices in connection with MassMutual Ascend’s products. Investors acquire MassMutual Ascend’s products from MassMutual Ascend and investors neither acquire any interest in the Indices nor enter into any relationship of any kind whatsoever with Barclays upon making an investment in MassMutual Ascend’s products. MassMutual Ascend’s products are not sponsored, endorsed, sold or promoted by Barclays and Barclays makes no representation regarding the advisability of MassMutual Ascend’s products or use of the Indices or any data included therein. Barclays shall not be liable in any way to MassMutual Ascend, investors or to other third parties in respect of the use or accuracy of the Indices or any data included therein.

For use with contract forms P1112916NW, P1112916ID, P1112916OR, P1470017NW, P1470017ID, P1470017OR, P1129918NW, P1129918ID, P1129918OR, P1129918NW, P1129918ID-NoMVA, P1129918OR, P1074514NW, P1074514ID, P1074514OR, ICC21-P1152121NW, ICC21-P1476721NW, P1140219NW, P1140219ID, P1140219OR, P1140119NW, P1140119ID, P1140119OR, P1110416NW, P1110416ID, and P1110416OR. Contract form numbers may vary by state.

All guarantees subject to the claims-paying ability of MassMutual Ascend Life Insurance CompanySM.

Products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual).

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F1176525NW

Have questions? Get in touch with a financial professional.

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.